Blog

Redefining Legacy: The Message We’re Carrying Into 2026

Over the years, one pattern has become impossible to ignore in our work with individuals, families, and business owners alike: legacy planning is postponed far too often. Not because it lacks importance, but because it’s misunderstood.

Read MoreSix Investing Personas & the Quiet Tensions That Shape Our Money Decisions

Most investing mistakes aren’t about markets. They’re about behavior. This article explores six common investing personas, how they collide inside families, and how thoughtful structure helps money decisions feel calmer and more aligned.

Read MoreWhen Sweden Joined the Fight: Why Neutrality Won't Work for Your Retirement

Sweden chose neutrality to protect its own security, until it ultimately realized that picking a side was the better choice to accomplish that same goal: security. In retirement planning, you will likely confront the same realization...

Read MoreRetirement Planning: How Did We Get Here (And How Do We Get THERE?)

The retirement planning landscape changed forever in the early 1980s, and many people today have limited awareness of what we lost in the process. The Economic Policy Institute described 401(k)s as “a poor substitute” for the pensions...

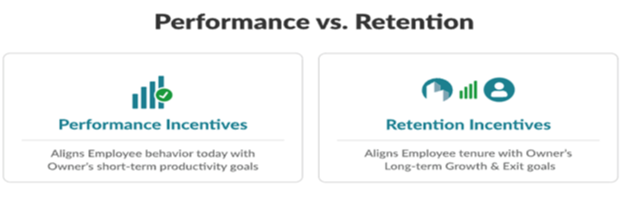

Read MoreBuilding Value Beyond Salaries: How Incentive and Retention Plans Fuel Growth, Continuity, and EV

Top talent can build enterprise value, but only if they stay. Incentive and retention plans aren’t only perks, they’re strategic tools that align key employees with long-term growth, protect business continuity, and increase valuation...

Read MoreShow All

The Hidden Truth About Stock Picking: Most Lose, the Market Wins

Most stocks fail, but markets endure. From dice rolls to Roman aqueducts, history shows the power of systems over luck. Embrace diversification, humility, and the odds that actually win.

Read More"Would You Rather?" (Money Is Just a Proxy)

These thought experiments can help you to look beyond the raw numbers. Ask yourself: Which option gives me more of what I actually value? The answer might surprise you.

Read MoreLegacy Isn’t What You Leave for Your Children – It’s What You Leave IN Them | The Business Corner

“Legacy is not what you leave for your children. It’s what you leave in them.” - Shannon L. Alder We tend to think of legacy in terms of what we pass down – money, property, businesses. But the most powerful part of your legacy can’t...

Read MoreYour Financial Dashboard: What to Track (and What to Ignore) for Real Progress

You can have the best investments, the flashiest returns, the cleverest stock picks, and still end up financially stuck. Why? Because financial progress doesn’t come from reacting to headlines or tracking your portfolio like a heart...

Read MoreScarcity and Abundance: Money vs. Wealth

"Abundance" vs. "Scarcity" thinking intersect with wealth and money: Abundance mindset can change how we think about creating wealth, and understanding the risks of scarcity can change how we plan for having and enjoying that wealth.

Read MoreBuilding Wealth as a Family Team Sport

Wealth isn’t a solo journey, it’s a family team sport. Discover how shared values, early money lessons, and smart systems help families build lasting financial legacies across generations.

Read More"Why Wouldn't I Just...?"

"Why wouldn't I just...?" is so seductive because of its simplicity. It reduces complex financial decisions to straightforward actions with predictable outcomes. It feels empowering, as though it's a straightforward way...

Read MoreThe Two Faces of Risk: Probability and Tolerance

Successful decision-makers understand that it's not enough to bet on what's likely - you must also ensure you can handle what's unlikely. Learn how to make better decisions by combining two key approaches to risk.

Read MoreStop Playing Checkers with Your Business: Aligning Value, Risk, and Continuity | The Business Corner

Most business owners want the same thing: more value, less risk, and long-term continuity. The problem isn’t ambition or effort – it’s integration. When these elements are tackled in isolation, your business becomes vulnerable. When...

Read MoreFrom Stressed to Strategic: Turning Financial Anxiety into a Game Plan

Financial anxiety often isn’t about having too little, it’s about lacking clarity. This post explores how strategy calms stress, and why building a resilient, boring-but-brilliant plan is the real flex.

Read MoreIt’s Not Just About Profits – It’s About Life | The Business Corner

Too often, business owners believe planning is only about boosting profits, growing value, or walking away with a bigger payday when they sell. While these are undeniably important, they’re just part of the story. Effective business...

Read MoreBusinesses That Survive: Applying the Principles of Avoiding Failure

Once you identify the potentially fatal risks to your strategy, you can implement solutions to prevent them. And once you know you can't fail, you can press forward with confidence and take risks in a controlled environment.

Read MoreRecency Bias: The Hidden Trap in Your Financial Decision-Making

Maybe you can think of a time that it's happened to you. The stock market takes a dramatic plunge, and suddenly you're convinced investing is too risky. Or maybe a particular industry has been booming for months, and it seems like...

Read MoreWhy Smart Savers May Lose Without a Tax Plan

Smart savers can still lose big without a tax plan. Learn how tax diversification, Roth conversions, and the Three-Bucket Strategy can protect your retirement and legacy.

Read MoreBusiness Planning Isn’t Only for the Exit - It’s for the Climb | The Business Corner

You don’t climb a mountain by accident, and you don’t build a durable business without a plan. Even if selling isn’t on your radar, smart business planning gives you more freedom, more control, and more peace of mind.

Read MoreAvoiding Failure: A Foundation for Winning Strategies

“The Duesenbergs were always looking to get an edge...they would do anything they could to go faster, win more races, achieve higher speeds.” So why did a team obsessed with speed focus so much on stopping the car? And why did it work??

Read MoreThe Hidden Pay Gap & The Two Yous: Why Business Owners Should Separate Salary from ROI

There's a distinction many entrepreneurs miss: the difference between compensation for your time and return on your investment. You deserve both fair compensation and investment returns.

Read MoreIt's Not What You Have, It's How You Live

It's normal, but misguided, to think that financial success is best measured by the total amount of wealth one accumulates. True success is not defined by the numbers on a statement, but rather by how that wealth enhances our lives.

Read MoreResilient by Design: Why Great Financial Plans Ignore the Headlines

The rise and fall of Pets.com reminds us: markets run on emotion as much as math. Build a resilient financial plan that protects behavior, diversifies risk, and prioritizes purpose over hype—especially when headlines scream.

Read MoreFinancial Mechanics of Business Planning: Maximizing Value with Strategic Decisions: Business Corner

Business Decisions: The Importance of Data Business planning is more than just setting goals – it’s about making informed, strategic decisions that lead to financial success. Too often, business owners rely on gut feelings rather than...

Read MoreWhy You Might Care About Volatility, Even If You Think You Don't

Volatility is not just a psychological inconvenience that you can withstand by simply looking away or getting comfortable with it - it's a mathematical reality with real world implications.

Read More5 Ways to Allow for Chance: Probabilism vs Determinism

Financial life is probabilistic (involving uncertainty), but people want it to be deterministic (responding predictably to a set of knowable rules). This leads to a disconnect between behavior and the principles of sound strategy...

Read MoreDon't Let the Tax Tail Wag the Dog

Making effective financial decisions can be difficult enough without letting tax considerations hijack your primary objectives. Let your life goals and sound financial principles be the proverbial "dog"...

Read MoreThe Invisible Edge: What Separates the Best Business Owners from Everyone Else | The Business Corner

The difference between the best and everyone else isn’t luck, education, or industry – it’s the invisible factors: the discipline, leadership, resilience, and long-term thinking. These feats of strength separate those building incredible...

Read MoreWhy Strong Foundations, Not Flashy Returns, Build Enduring Wealth

The Romans mastered aqueducts to channel water efficiently—your finances should work the same way. Without a system, even high incomes can slip away. Build financial clarity, automate savings, and direct income flow with purpose.

Read MoreChoosing Your North Star: Zen Intention-Setting & Modern Goal Achievement

Intentions act as a compass rather than a destination - they guide our moment-to-moment choices while allowing space for life's natural flow.

Read MoreThe Evolution of Investing: Why Direct Indexing May Be a Game Changer

Direct indexing blends the simplicity of indexing with personalized strategies like tax efficiency and portfolio customization. Discover how it transforms wealth management for modern investors.

Read MoreRethinking Norms: Lifestyle Creep (The Right Way)

Lifestyle creep doesn't have to be a negative. By approaching it with intention, strategy, and a focus on leveraging your time and resources, you can create a life that's both fulfilling in the present and secure in the future.

Read MoreUnderstanding Your Financial Statements: The Key to Empowered Decision-Making | The Business Corner

Your company's financial statements are more than just compliance requirements; they are the heartbeat of your business, offering insight that guides decision-making and illuminates opportunities. Decode your financial statements...

Read MoreCreating a Historic Year: The Pendulum Effect | The Business Corner

Another new year is on the horizon – a fresh start, blank page, and open invitation to greatness. For business owners, Q4 (or your year-end) presents the perfect moment to reflect, recalibrate, and commit to what truly matters. In a...

Read MoreAvoiding Regret: Learning From Others' Experience

Many are lulled to sleep by seemingly simple and straightforward growth strategies; the reality of financial planning is much more than investing — it’s about preparing for the unexpected, protecting what matters most, and ensuring that...

Read MoreThe Family Financial Playbook: Navigating Intra-Family Loans

Intra-family loans: a creative financial play that saves on interest, preserves investments, and fosters trust. Structured right, they tackle debt while strengthening family bonds. Prepare, communicate, and win together!

Read MoreIn the Long Run, We’re All Dead: The Practical Limits of Statistical Thinking

The famous quote by economist John Maynard Keynes, “In the long run we are all dead,” has often been misinterpreted as flippant or dismissive. However, when read in full context, Keynes wasn’t making a nihilistic joke; he was issuing a...

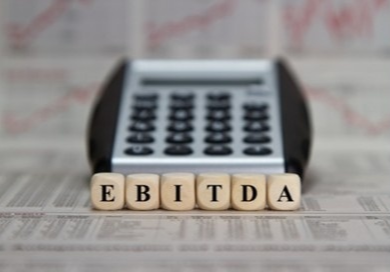

Read MoreBeware of EBITDA: The Other Side of the Story | The Business Corner

EBITDA is often the go-to measure for businesses, investors, and acquirers. However, as with any powerful tool, EBITDA has its limitations – many of which are often overlooked but critical to understand.

Read MoreBeyond the Flash: Strengthening Your Financial Foundations Through Strategic Tax Planning

Discover the key to lasting wealth by balancing investments, tax strategy, and resilience against market shifts. Avoid chasing flashy returns—build a foundation of enduring financial success that secures your legacy for generations.

Read MoreGambling Distortions and You: The Perils of Sector and Single Stock Investing

It's no secret that stock investors can sometimes fall prey to certain psychological distortions, fallacies, and biases, and they can be hard to recognize when they're happening to you. Learn more about the Gambler's "Conceit", "Ruin"...

Read MoreUnderstanding the Hidden Beliefs that Shape Your Finances: Money Scripts

Money is often seen as a straightforward tool for managing resources, but for many of us, it’s far more than that. It’s wrapped in emotions, personal history, and deep-seated beliefs that can influence how we handle finances—whether...

Read MoreEBITDA: Understanding the Key Driver in Business Success | The Business Corner

EBITDA is more than just a financial metric; it's a tool that highlights the strength of a company’s core operations. It's a key indicator that allows business owners, investors, and potential buyers to comparably assess profitability...

Read MoreUnderstanding the Vital Role of Insurance in Building a Resilient Financial Plan

Explore the vital role of insurance in financial resilience. Learn how life, disability, and other insurance types protect you and your family from life’s uncertainties, acting as a strong foundation in your financial plan.

Read MoreRethinking Norms: Risk Tolerance, and Why Your Score May Be Wrong

Have you ever taken a risk tolerance questionnaire? These assessments are designed to gauge your comfort level with investment risk, often assigning you a numerical score. While they can be a useful tool, it's important to recognize...

Read MoreA (First Principles) Guide to Understanding Trust Objectives

There's a lot of confusion around trusts. The purpose of this guide is to help you begin thinking in a structured way about (1) what it is you really want and (2) what is (at least sometimes) possible.

Read MoreWhy Planning Ahead Matters: Knowing Your Roadmap from the Beginning | The Business Corner

If you were to climb a colossal mountain like Mount Everest, when would you want to know how you were getting down from the mountain? Once you've already reached the summit, or before you pack your supplies and begin climbing?

Read MorePremium Financing and Leverage | What Makes Sense and What Doesn't

"Premium Financing" refers to the use of borrowed money to pay life insurance premiums. While unscrupulous advisors have been derided for their usage and approach, there are some good reasons to consider it, in the right situation.

Read MoreCultivating Financial Calm: A Mindful Guide to Building Wealth and Peace

Managing your finances mindfully is like tending a farm—it takes patience, consistency, and care to see long-term growth. Simplify complex financial strategies with our holistic advisory team. We'll guide you toward lasting financial peace

Read MoreThe Second Bite of the Apple: Maximizing Your Earnings After Selling Your Business | Business Corner

For many business owners, selling their company is a momentous milestone – often the culmination of years of hard work, long hours, and strategic growth. What some may not realize is that the initial sale doesn't have to be the end of...

Read MoreThe Risks of Rolling Equity - What to Know Before You Roll

"Taking a Second Bite of the Apple" in a business exit happens often variety of both buyer- and seller-driven purposes. The reasons to "roll equity" forward are many, but there are some critical issues to get a handle on before you commit.

Read MoreWhy Financial Gurus are Failing Us: The Pitfalls of One-Size-Fits-All Advice

Many financial gurus use simplified advice to market themselves, but this approach can harm real-life finances. True success requires personalized, nuanced strategies that focus on long-term growth, discipline, and personal goals.

Read MoreThe Generational Decline: Why Success Becomes Harder with Each Generation in a Family Business | The

The adage "shirtsleeves to shirtsleeves in three generations" has proven to be more than just folklore. The statistics reveal a daunting challenge for those at the helm of family enterprises. But what drives this generational decline?

Read MoreA Different View of Investment Returns | The Stock Market Machine's "Cost of Capital"

The stock market may seem like a retirement savings vehicle, but its intent is to allocate capital to companies. Understanding "cost of capital" can help reframe what makes for a reasonable investment return expectation.

Read MoreSimplicity is Comfortable, but Complexity is Worth It

It’s easy to gravitate toward simple plans. They’re quick to create, easy to understand, and familiar, because they often resemble what you've seen from everyone else. Complex doesn’t mean complicated for the sake of it; it means...

Read MoreThe Paradox of Prosperity: Pitfalls of Success and How it Might Affect You

With success, you may have encountered distinct concerns and challenges that differ from those of others...and you may be surprised by how many ways these challenges can come into being for people who weren't always in this position...

Read MoreReimagining Retirement: Why FIRE Misses the Mark

The siren call of the FIRE (Financial Independence, Retire Early) movement has captivated many young professionals – amass a fortune by your 30s and bid farewell to the 9-to-5 grind. Countless influencers flaunt their early retirement...

Read MoreProfits and Value: The Long and Short of Business Success | The Business Corner

Grasping the critical difference between profits and value is essential to unlocking your business's true potential. These two elements, though intertwined, are distinct concepts that demand their own tailored strategies and approaches.

Read MoreHow to Teach Kids About Money: Fun and Educational Activities for Families

Introducing basic financial concepts early in the life of our children can build the foundation for a successful relationship with money. Creative games and activities can be a fun way to start with your children. Here we review some ideas!

Read MoreThe "Purest" Way to Increase the Value of Your Business

Picture a magic slot machine. Each time you pull the arm, you make back a multiple of whatever you wagered. How much time would you devote to cranking that arm? When it comes to the value of your business, you can make many bets, but...

Read MoreThe Power of Independent Thinking in Financial Planning

Becoming a free and independent thinker in a world overflowing with subliminal messages and dogmatic phonies is increasingly difficult. Many of us frenetically chase our tails, running from soapbox to dais screaming at those who...

Read MoreRethinking Norms: Risk & Moving Beyond Volatility

In the world of finance and investing, risk is often oversimplified as volatility, or fluctuations in portfolio value over time. This narrow definition fails to capture the multifaceted nature of risk and its impact on our lives and...

Read MoreIndispensably Dispensable: Understanding the Importance of Not Being Needed | The Business Corner

While it may seem counterintuitive, the most indispensable action a business owner can take is to ensure their business has the capability of operating smoothly without their constant presence. Here’s why and how you can achieve this...

Read MoreOne of the Most Important Factors in Retirement Planning That Almost Nobody Wants to Talk About

It's not easy to think about how long we're going to live because it requires us to estimate when we're going to die...

Read MoreChoosing the Right Acquirer for Your Business: Strategic vs Financial Buyers | Business Corner

In the context of mergers and acquisitions, the distinction between a strategic buyer and a financial buyer is crucial. This bifurcation affects both the approach to the acquisition as well as the post-acquisition integration and...

Read More"The Switzerland Structure": Building Value in Your Business

The "Switzerland Structure" cautions against excessive reliance on any single entity, whether suppliers, employees, or customers. While many business owners recognize the risks associated with dependency on a high-profile customer...

Read MoreWhen Should You Start Claiming Your Social Security Benefits?

If you want to start a lively discussion among a group of retirement experts, just casually toss out the question, "What's the best age to start taking Social Security?"

Read MorePutting All Your Eggs in One Basket: A Cautionary Tale

Presently, Nvidia is making the lion's share of computer chips that can handle the intensive processing required to run the advanced AI engines around the world...

Read MoreWhy You Should Always Be Planning Your Next Trip

In the 1970s Heinz Ketchup ran a series of TV commercials which highlighted an attribute of their product that many people saw as a frustration: It took a long time to pour their ketchup out of the bottle...

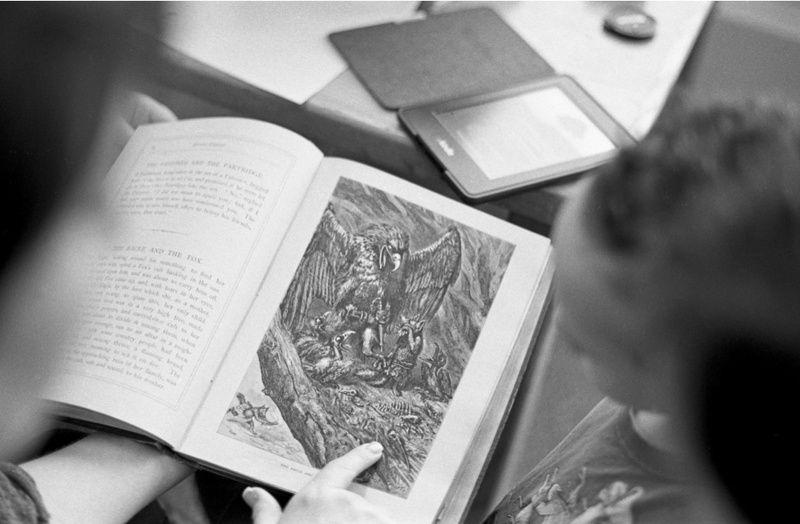

Read MoreFinancial Fables: Timeless Money Lessons from Classic Folklore

As innocent youths not yet bombarded by the conditioning of life’s marketing, children often grab on to fables with more speed than a quickly melting ice cream cone during the summer. These fictional stories creatively embed brilliant...

Read MoreFour Big Truths that Can Bring Clarity to Your Investing

Whether it's a raging bull market or a nerve-wracking correction, it's important to focus on the "why" that guides all of your investing actions.

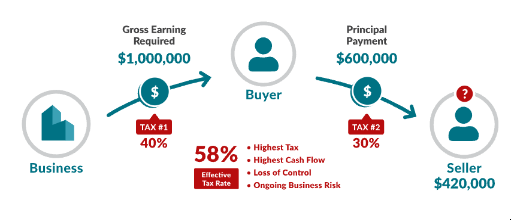

Read MoreStrategic Approaches to Mitigate Double Taxation and Enhance Inside Sales

Inside ownership sales, where business ownership is transferred internally to employees, executive groups, co-owners, and/or family members, pose unique challenges. One of many includes the significant hurdle of double taxation. As...

Read MoreRethinking Norms: The Dividend Mirage

It's conventional wisdom in financial planning that if you want to generate income from your portfolio (often in retirement), you should load up on dividend-paying stocks. The logic seems sound - companies that pay dividends will provide...

Read MoreNavigating the Nuances of Employee Incentives: Performance vs. Retention | The Business Corner

...I find there are two primary reasons people work: passion and money. In an ideal world, individuals would experience both from their work. However, as we all know, this is not always the case. As business owners, creating environments...

Read MoreThe True Cost of Actively Managed Investments

Not only are the exploits of the active managers more interesting, but they always seem to have a good reason for what they do. And when one of these funds chalks up a good year or two, you might wonder if you're missing out on something...

Read MoreAncient Financial Planning Philosophy: Stoic Wisdom on Controlling the Controllables

In today’s isolated and anxious landscape, we turn to the ancient Greek philosophy of Stoicism to find a playbook for suffering less internally and attaining some modicum of inner peace. Stoicism focuses on virtue and controlling the...

Read MoreComplicated vs. Complex Systems: Why the Difference Matters

When you're dealing with a system that has many moving parts, it can be easy to assume that it's inherently complex. However, there's an important distinction between complicated systems and truly complex systems - and understanding...

Read MoreThe Entrepreneurial Odyssey: Why People Choose to Become Business Owners | The Business Corner

What drives someone to take the leap into entrepreneurship? What motivates individuals to abandon the security of a traditional career path and venture into the unpredictable realm of business ownership?

Read MoreThe Era In Which You Started Saving Affects How You Invest

Your attitudes and expectations about investing are heavily influenced by the financial environment in which you first started putting money away. And those, in turn, affect your investing behavior.

Read MoreEmbracing Optionality: 8 Reasons to Base a Plan on Flexibility Instead of Prediction

Embracing Optionality, not Prediction: Calm and peace don’t come from knowing what will happen, they come from knowing that whatever happens, you’re ready. "Optionality" is the quality of being available as a choice, but not obligatory.

Read MoreUsing Economic Data to Predict the Market? It's a Waste of Time

Peter Lynch had a famous quote: "If you spend 13 minutes a year on economics, you've wasted 10 minutes." A stock analyst who writes about the market under the penname Courage & Conviction recently looked at how wrong the big name forecas...

Read MoreBusiness Growth with Retention Strategies | The Business Corner

If you've ever experienced losing a vital team member firsthand, or even just worried about it, then you understand the significant impact this can have on a business. The people form the business, so understanding what motivates and...

Read MoreHow Your Personality Can Affect Your Investment Performance

There are some people who would love it if you threw a surprise birthday party for them. They'd enjoy every aspect of it, from the sudden yell of "Surprise!" to being the center of attention to eating cake with a large group of friends...

Read MoreThe Paradox of Progress: The Revolution of Rising Expectations and Maslow's Hierarchy of Needs

One might expect that revolutions occur in a society where conditions have gotten so bad that citizens are fed up, and have no choice but to rise up in a desperate attempt to change the status quo. Instead, however, revolutions...

Read MoreUnderstanding the Psychology of Financial Planning: Why Important Decisions Can Take the Backseat

Most people have great goals. The issue is ensuring actions are aligning with those goals. We cannot allow this cognitive dissonance to run our operation. Yet knowing where to start and what to even ask is what I believe often holds...

Read MoreForecasts: Reasonable, Methodical, and Wrong

Late in 2022 the strategy team at Goldman Sachs Research released their forecast for the U.S. stock market in 2023.1 Based on what had happened the year before and on where the economy appeared to be headed, it seemed to be...

Read MoreMastering Decision-Making in Business: Leveraging the Eisenhower Matrix | The Business Corner

In the fast-paced world of business, effective decision-making is a cornerstone for success. We only have so many hours in the day and, as...

Read MoreThe Downside to Target Date Funds

At first glance these funds might seem like a great idea. But unfortunately, things don't always end up working the way they were designed to. And these funds have been getting more critical scrutiny...

Read MoreThe Craftsman or the Tools: Which Matters Most?

You may have heard the old adage that "a craftsman is only as good as his tools." Today, I'd like instead to explore the converse of that statement, that tools are only as good as the craftsman who wields them. I'd argue that even...

Read MoreWelcome to the Holiday Season: How to make 2024 even more successful than 2023 | The Business Corner

The pursuit of having your best year in business is a common aspiration among entrepreneurs and professionals. With the right mindset and strategies, this ambition can become a reality. Here's a comprehensive guide to help you make the...

Read MoreAsk Yourself, "Why Am I Reading This?"

So, how good were the suggestions from mainstream financial news sources in 2022?

Read MoreDistribution is Different: What You Might Not Know About the 4% Rule

When you reach the phase where your assets must fuel your future income, how exactly will you get funds off of your balance sheet?

Read MoreSteering the Ship: The Significance of KPI and KAI Tracking | The Business Corner

Businesses need to make informed decisions, identify trends, and continuously adapt their strategies. These metrics are the compass that guides your business toward its objectives.

Read MoreHow Do You Plan for a Future You Can't Accurately Predict?

The "end of history" illusion describes an inability to see ourselves changing substantially from how we are today. You shouldn't lock yourself into a future that won't fit who you are (or might be) in twenty years.

Read MoreThe Search for Smoother Returns: Demystifying Factors, Alts, and Modern Portfolio Theory

Explore the important concepts around what it would take to build a portfolio with more stability and balance over time, how they can work together, why you should care, and what to do about it.

Read MoreMaximize Business Success: Plan With the End in Mind | Business Corner, October 2023

Imagine embarking on a long journey without a map. When you're ready to scale and grow, you need a dynamic, forward-thinking approach that empowers your organization to navigate uncertainties while staying true to its mission.

Read MoreWhen the Fear of Missing Out Causes You to Miss Out

Like any proverb, "The early bird gets the worm," has its limitations. You are going to want to pursue actions that have the best chance of resulting in success over the long-term.

Read More[ARCHIVED] The Subsidy Is Running Out: Why Cheap Urban Amenities Aren't So Cheap Anymore

How and why your ride was previously so cheap because it was being subsidized by an investor.

Read MoreWhy Redundancy is Your Financial Best Friend: Strategies from the Engineering World

Learn what engineers have known for a long time: Stop thinking of "redundancy" as a cost to be avoided, and start thinking about what it can contribute to your life.

Read MoreWhy You Should Think of Yourself Like a Business: Net Worth is Dynamic, not Static

Unlike individuals, businesses are assessed based on their potential to generate future cash flows. It likely pays to think of yourself the same way.

Read MoreWhy Patience Is Not Enough

Patience is a virtue, but... Patience is not enough. Let's talk about the importance of establishing the correct positioning.

Read More

![[ARCHIVED] The Subsidy Is Running Out: Why Cheap Urban Amenities Aren't So Cheap Anymore](http://static-stage.fmgsuite.com/media/ContentFMG/thumbnails/e7062ed6-22f4-4273-bb76-583d300f5b9a.jpg?v=2)