Through my experiences, I find there are two primary reasons people work: passion and money. In an ideal world, individuals would experience both from their work. However, as we all know, this is not always the case.

As business owners, creating motivating environments for our employees, especially key personnel, is essential. This can be accomplished through various means – setting goals, promoting the company's mission, ensuring continuity, providing mentorship, offering growth opportunities, encouraging education, implementing perks, and a plethora of additional approaches.

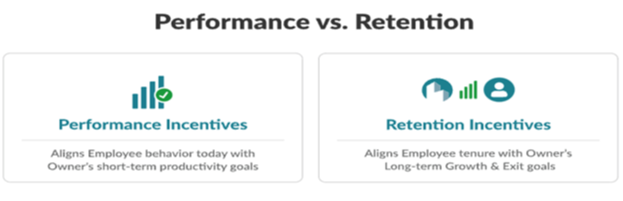

This article will shine a light on two varying motivational techniques focused on the monetary aspect – performance incentives and retention incentives. These differing tools in a business owner's arsenal each play a unique role in shaping the company's future and enhancing its value. Understanding the similarities and differences between these incentives, alongside recognizing the profound impact of employee retention on a business's exit strategy, is crucial for any business owner aiming for long-term success and stability.

Let's explore further:

PERFORMANCE INCENTIVES – FUELING IMMEDIATE PRODUCTIVITY

Performance incentives are structured to motivate employees to achieve specific short-term objectives that contribute to the company's immediate productivity and efficiency. These incentives are often quantifiable and directly linked to measurable outcomes, such as sales targets, project completions, or quality benchmarks. The primary aim is to encourage behaviors that bolster the company's current operational performance, with rewards typically manifesting as bonuses, commissions, or other immediate forms of recognition.

RETENTION INCENTIVES – CULTIVATING LONG-TERM COMMITMENTS

In contrast, retention incentives are designed with a long-term perspective, aiming to secure the continued service and loyalty of key employees. These incentives are crucial for maintaining a steady and experienced workforce, which is instrumental in achieving sustained growth and facilitating a smooth business exit – whether a sale to insiders, third-party transaction, or transitioning to passive ownership. Effective retention strategies often involve deferred benefits that cater to significant life milestones, thereby fostering a deep-rooted commitment to the organization.

THE CRITICAL ROLE OF EMPLOYEE RETENTION

Employee retention transcends beyond merely reducing turnover rates; it is a strategic component enhancing a business's marketability, sale price, and operational continuity.

Here's what this looks like:

- Creating a Market for Sale to Insiders

- A committed and skilled workforce is attractive to potential internal buyers, such as management teams or employees, providing a viable exit route for the owner. - Boosting Salability and Purchase Price for Sale to Third-Parties

- Buyers are willing to pay a premium for businesses with a stable, reliable team, reducing the risks associated with the transition. - Facilitating Transition to Passive Ownership

- Retained employees can manage day-to-day operations, allowing the owner to step back without relinquishing ownership. - Preserving Value in Unexpected Circumstances

- In cases of unforeseen exits due to health issues or other emergencies, a loyal and experienced team ensures business continuity, maintaining its value.

BEYOND TRADITIONAL BENEFITS – CRAFTING EFFECTIVE RETENTION STRATEGIES

While benefits like health insurance, 401(k) matches, and annual bonuses are valuable, they often lack the retention power to secure long-term commitment. Effective retention strategies should:

- Be Completely Deferred

- Ensuring that the real value of the incentive is realized in the future encourages employees to stay with the company over the long haul. - Address Emotional Milestones

- Linking incentives to significant personal milestones, such as retirement or children's education, creates a more profound connection and loyalty to the company. - Maintain Simplicity

- Complex incentive plans can be confusing and less motivating. Keeping the structure straightforward makes it easier for employees to understand and value the benefits. - Provide Security

- Plans should cover critical "what if" scenarios—employment, illness, and death—providing employees with peace of mind that they and their families are protected in all three instances.

THE TAKEAWAY

Understanding and effectively implementing performance and retention incentives is crucial for aligning employee efforts with the company's short-term and long-term objectives. As the business owner navigates through growth phases and towards exit strategies, the emphasis on strategic retention cannot be overstated.

It is not only about offering benefits but creating a sense of security, motivation, and alignment with employees' life goals. Such strategies enhance business value while also building a resilient and committed workforce, ready to support the company through transitions and beyond. Taking a broader view, this strategic planning is definitely a worthwhile endeavor where everyone can benefit.