About Us

Who We Are

Ashford Advisors was founded in 1898 with the same principles that guide the firm today: Trust. Honesty. Integrity. We believe values matter, and we live by them every day.

“This is our commitment to you – to do all in our power to protect your wealth today and for decades to come, to maximize its growth within your boundaries of risk, to help provide you with the security and the assets you need to enjoy all the days of your life.” – CEO, V. Thomas Purcell, CLU®, ChFC®

Over time, the firm has expanded to offices in five states that guide clients across the country. We have a strong commitment to helping our community and improving the lives of those we serve.

What Do Our Clients Learn from Working With Us?

Our mission is to help families achieve peace of mind and financial clarity. We are a partner to help you reach your vision for the future.

Do I understand my cash flow? Am I saving enough? Spending too much? Where does my money go?

What percent of my income should I be saving, and where should I save it?

When was the last time I reviewed and evaluated my insurance coverage, my will, or my group benefits?

How should I be saving for college? Are my kids covered?

Do I have a coach to keep myself on track financially as life changes?

How do I consolidate retirement and investment strategies?

What does it cost to have a financial advisor?

What should a relationship with a financial advisor look like?

Our Process for You

Many people feel overwhelmed by multiple competing financial concerns, opinions, and products. That can lead to stress and uncertainty — and poor decisions with their money.

It’s important to first organize financial priorities and understand the proper order for addressing your specific situation. Take care of today, establish a good foundation to respond to life events, and then build on that solid framework to prepare for the time ahead.

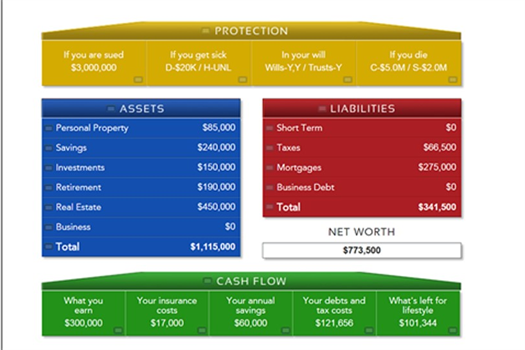

The Living Balance Sheet® provides our clients with a complete wide-angle view of their financial world. Let us help you make the choices that are right for your future.

The Living Balance Sheet®

Using The Living Balance Sheet®:

Our planning process helps clients get organized in a way they have never experienced before:

1. Understand all the pieces of your financial picture and how they work together.

2. Minimize financial ups and downs and start creating a greater sense of balance.

We are comprehensive in our approach. We will help organize your financial life, educate you on the concepts and strategies that will have great impact, and guide you in the implementation of your plan.

Small Steps Lead to Big Results Over Time

Step One: Protect Your Balance Sheet

We will help you protect against the biggest threats to long term financial success.

Step Two: Create a System for Saving

We will help you design a cash flow system to save more money than you thought possible without changing your lifestyle.

Step Three: Wealth Management

With a strong foundation in place, we will help you grow your wealth efficiently and move you towards your vision for the future.

The Living Balance Sheet® and The Living Balance Sheet® Logo are registered service marks of The Guardian Life Insurance Company of America (Guardian), New York, NY. © Copyright 2005-2021 Guardian. The Living Balance Sheet® system displays the financial holdings identified by the client based upon information and valuations provided directly by the client or by electronic feeds from the client’s financial institutions. Valuations provided by electronic feeds reflect the most current information provided by the financial institution as of the date and time noted, but can reflect valuations from an earlier date and time.