Investment

Investing should be easy – just buy low and sell high – but most of us have trouble following that simple advice. There are principles and strategies that may enable you to put together an investment portfolio that reflects your risk tolerance, time horizon, and goals. Understanding these principles and strategies can help you avoid some of the pitfalls that snare some investors.

The Fed and How It Got That Way

Here is a quick history of the Federal Reserve and an overview of what it does.

Have A Question About This Topic?

From Boats to Brokers

From the Dutch East India Company to Wall St., the stock market has a long and storied history.

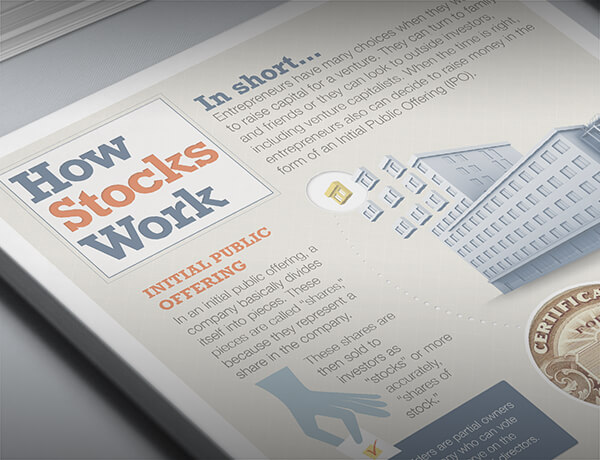

How Stocks Work

Understanding how a stock works is key to understanding your investments.

The Business Cycle

How will you weather the ups and downs of the business cycle?

How to Invest in LGBTQ+ Friendly Companies

This article allows those who support LGBTQ+ interests to explore the possibilities of Socially Responsible Investing.

Best-Performing Asset Classes

Bonds may outperform stocks one year only to have stocks rebound the next.

Key Money Moments: 4 Times You Should Talk to a Pro

Life happens fast, and your finances can take a backseat if you’re not careful. Is it time to check in with a financial professional? This infographic will help you examine your own financial situation and decide if it’s time to step up your financial game.

Financial fixes: Beware of market bubbles

Ideas on how to build a solid investment portfolio.

Diversification, Patience, and Consistency

Three important factors when it comes to your financial life.

Estimating the Cost of College

This worksheet can help you estimate the costs of a four-year college program.

View all articles

Taxable vs. Tax-Deferred Savings

Use this calculator to compare the future value of investments with different tax consequences.

How Compound Interest Works

Use this calculator to better see the potential impact of compound interest on an asset.

Saving for College

This calculator can help you estimate how much you should be saving for college.

View all calculators

What Smart Investors Know

Savvy investors take the time to separate emotion from fact.

The Rule of 72

Do you know how long it may take for your investments to double in value? The Rule of 72 is a quick way to figure it out.

Inflation and Your Portfolio

Even low inflation rates can pose a threat to investment returns.

Global and International Funds

Investors seeking world investments can choose between global and international funds. What's the difference?

It Was the Best of Times, It Was the Worst of Times

All about how missing the best market days (or the worst!) might affect your portfolio.

The Business Cycle

How will you weather the ups and downs of the business cycle?

View all videos

-

Articles

-

Calculators

-

Videos