One question that I frequently get asked is which is more important, a.) The rate of return that I get in my portfolio, or b.) The amount I should be saving. I would argue that the answer to the question is the rate at which you save is way more important than the rate of return that you might chase in your portfolio.

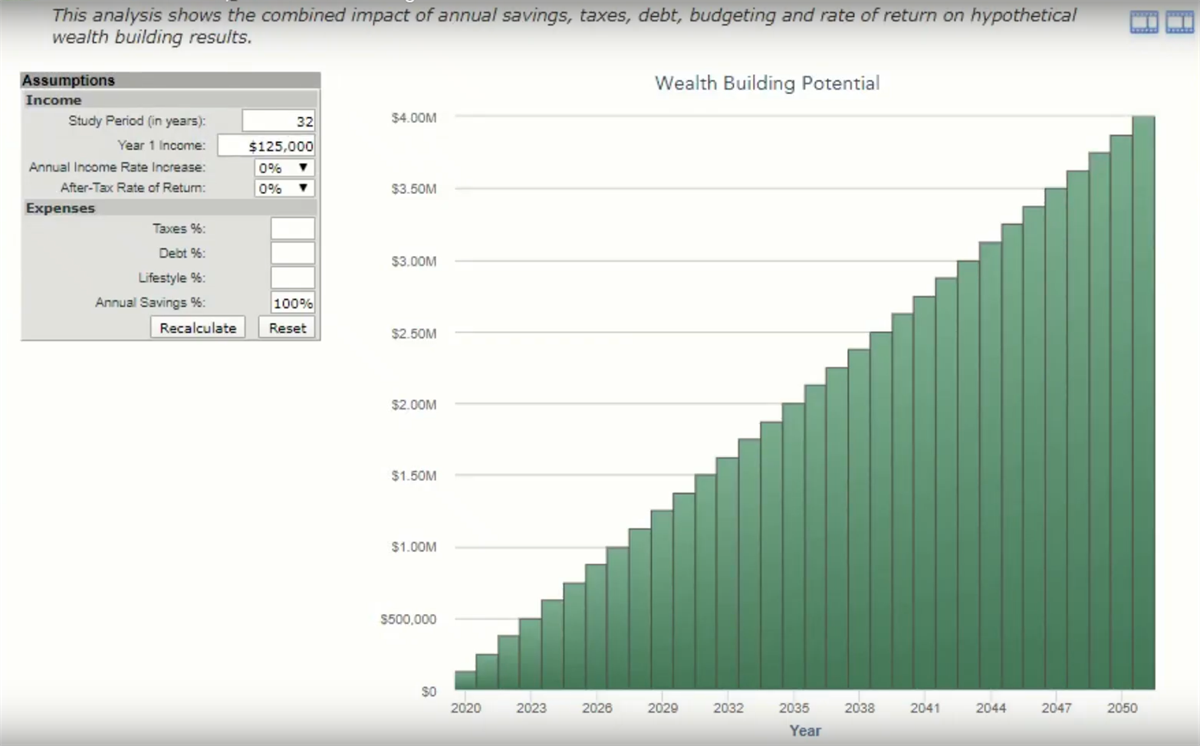

What you see pictured above is a hypothetical couple; their household income is $125k, and they have roughly 30 plus years in the marketplace left. Now, if we simply took their income for the next 32 years, and it didn't change a bit, their income earning potential is around $4 million. However, common sense would tell us that no one's going to stay in a job where they don't get any raises or promotion along way.

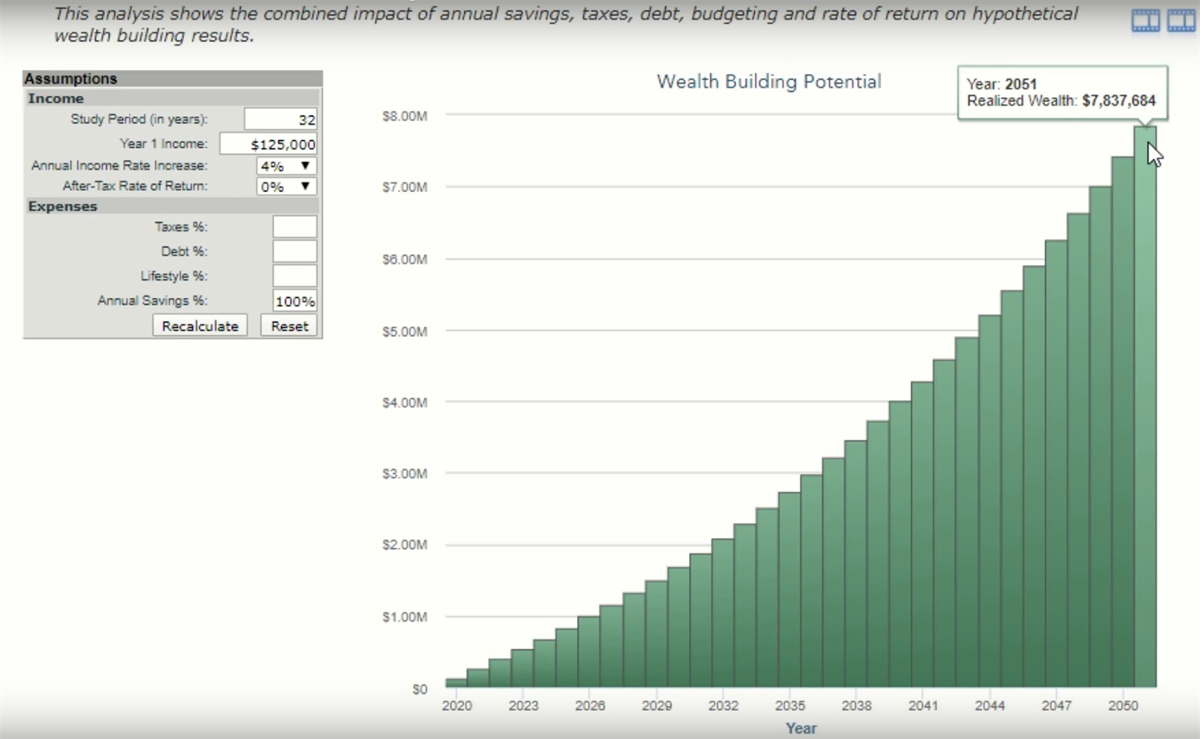

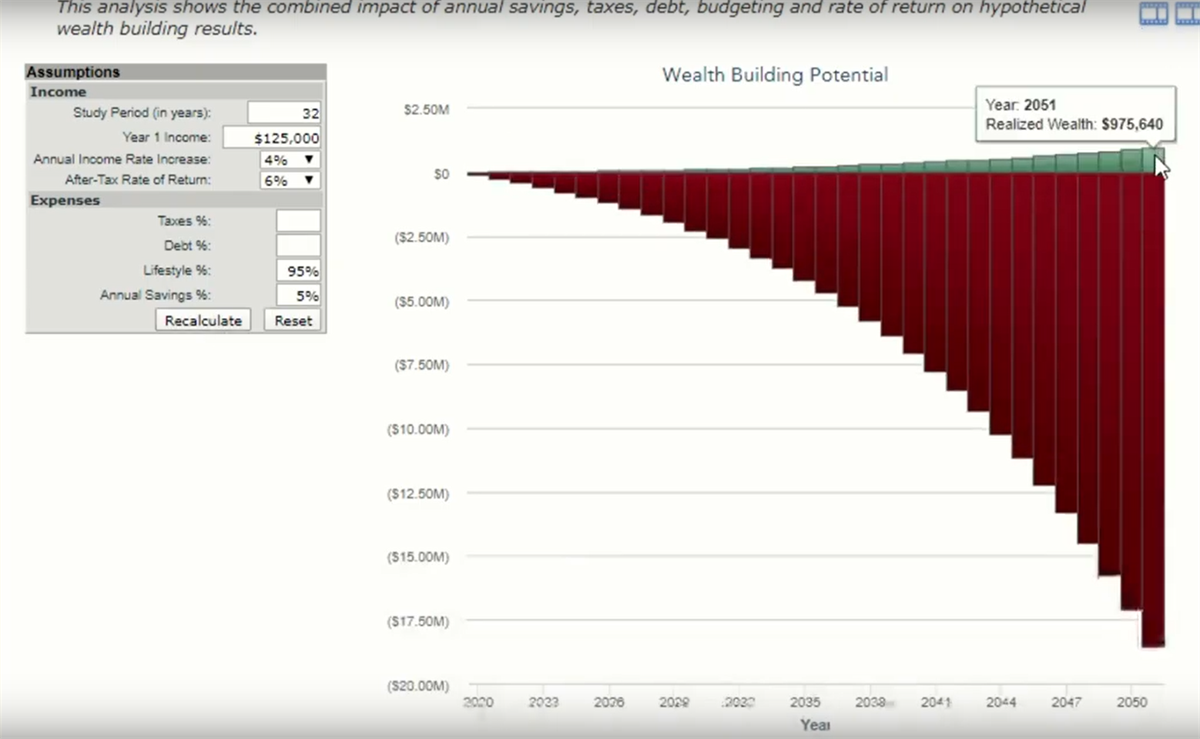

If we use an average annual income rate increase of 4% and recalculate (above), this couple will have almost $8 million of income over the next 32 years. Unfortunately, we don't get to keep all of that. In fact, once you add up taxes, debt, and lifestyle, that takes up roughly 95% of a person's cash flow. Often in the marketplace what we're seeing is people are putting maybe 5% of their 401K, they're getting matched at work, and they feel pretty good about that. Believe it or not, when you only save 5% of this $8 million earning income potential, what you're left with isn’t always ideal.

After spending almost $7.5 million dollars on debt, taxes, and lifestyle, they only have $4 hundred-thousand dollars to retire off of. One of the arguments in the marketplace today is about the focus on rate of return. Many people interview financial advisors to help them invest their money; those advisors will talk to them about the potential rate of return that they could get or their mutual funds. They get you interested in the idea of investing with them because of the projection of return that they can use.

Often times the client will say, “Yeah, Jason, I really think I could get 6% a year over the next 30 plus years in my portfolio,” and while it's possible to achieve almost $1 million net-worth…That 6% after-tax rate of return every year for 32 years has never happened in this country. In fact, the pre-tax equivalent of that is roughly around 9%-10%. What we help our clients understand is that the rate of return that we get in our portfolios is important, but something that's way more important is the rate at which you save.

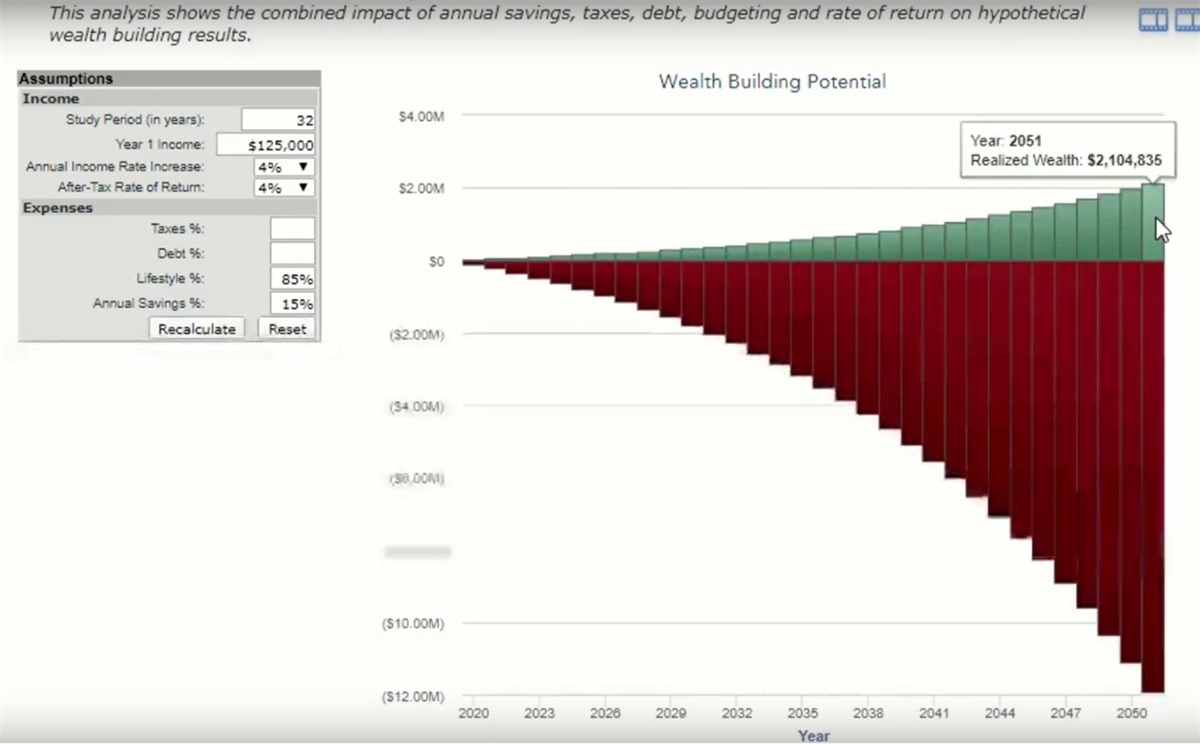

We're very good at helping our clients understand cash flow, its importance and how we need to prioritize and steward that cash flow. Oftentimes, we have found that it is way easier for clients to save more money than they ever thought they could without compromising their lifestyle, if we simply teach them a new cash flow system and the way that they can potentially save money for the long term.

By effective redistribution, we send our direct deposits to our savings account instead of our checking account and saving first as opposed to saving whatever's left over. All I did was simply adjusted to where this client was saving 15% of their gross income. If we were to use a 4% after-tax rate of return over the 32 years, we've got a lower rate of return by almost a third. However, we're focusing on what's more important which is the rate at which they save. Watch what happens to their ability to build wealth? It's more than doubled.

We feel as though it is mission critical for you to get your cash flow under control. If you're interested in learning more about the systems and some of the techniques that we use, we would be happy to share them with you.

Thanks so much.

2020-94756, exp. 2/22