Estate Planning

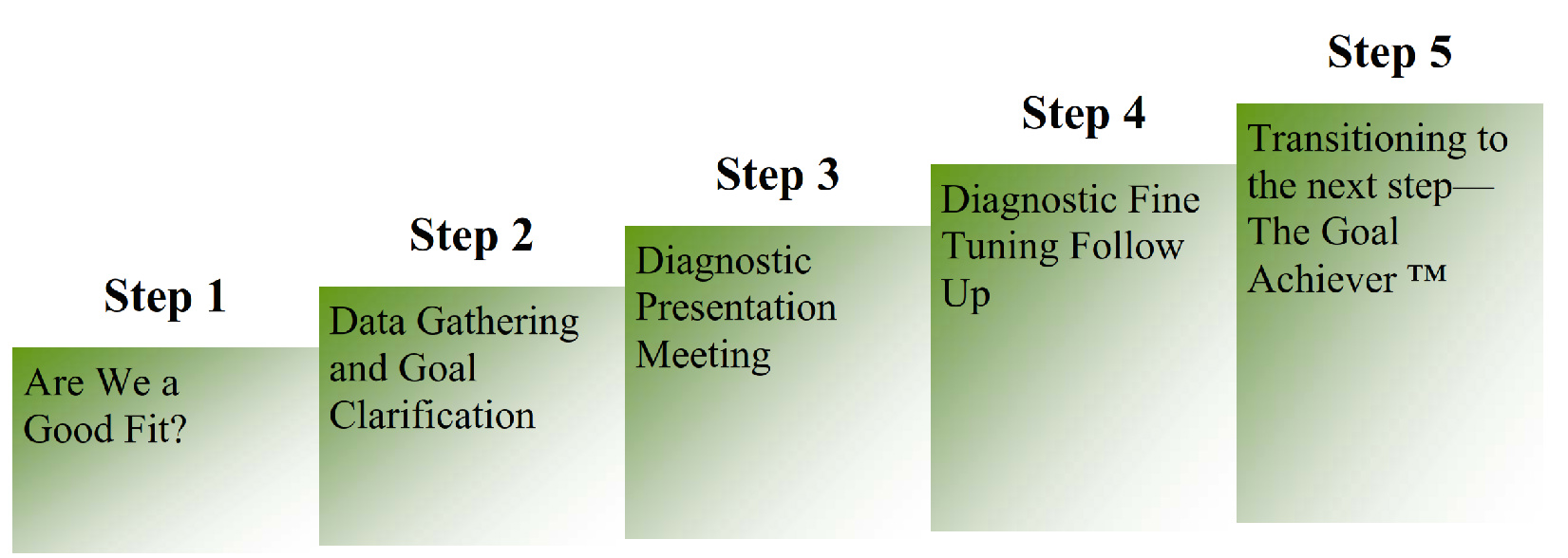

Step 1 The Diagnostic Fit Meeting

This first meeting will allow us to understand who you are and your major concerns. During this meeting, we will discuss our entire process in detail. Our goal is to determine if our process is a good fit for you, your family and our firm.

Step 2 Data Gathering and Goal Clarification

Before our next meeting we will collect substantial amounts of family data, financial information, legal documentation and tax returns. These are critical for a successful outcome.

At our next meeting we will review the data provided. More importantly, we will spend a great deal of time with you discussing and clarifying your goals and helping you to think about prioritizing those goals so that you end up with meaningful and useful information.

Step 3 Diagnostic Presentation

Once we have reviewed all of your existing documents and financial information and helped you to prioritize your goals and objectives, we will produce a financial model that demonstrates the results of your existing planning. This allows you, your advisory team and our firm to assess your current situation and determine whether or not additional planning would be appropriate and desirable for you.

Step 4 Fine Tuning Follow Up

During the presentation of the Diagnostic you may see something that is missing, not quite right, or determine that new information needs to be included in the model. In such a case, we will adjust the Diagnostic until you are satisfied that it truly represents your situation. This step in the process is very important since it creates a baseline against which to measure the results of future planning and provides a source for determining and understanding opportunities.

Step 5 Transitioning to the next step – The Goal Achiever ™

The Diagnostic provides you with possibilities and potential. It leads naturally to the next phase in our process – The Goal Achieve. ™ This phase, entered into once we jointly reach a determination that you can gain significant benefits from further planning, involves the creation of a blueprint from which future planning will be built.

Areas of Greatest Risk – Do you want to know?

- Will I have cash flow problems?

- Are there holes in my planning?

- Am I reaching my goals and objectives?

- Can I reduce income taxes?

- How do I reduce estate tax liability?

- Do my documents match my intention?

The key to fixing a problem is knowing that a problem exists. That is what the Diagnostic process is all about. Making sure that if serious problems exist, they are uncovered and brought to your attention.

Areas of Greatest Potential – What are the Possibilities?

- Protecting my wealth during my lifetime

- Controlling the spending of my tax dollars

- Creating more wealth

- Leaving more of my wealth to my family

- Supporting the causes that are important to me

Simply, our goal is to help you see the possibilities so that you can choose which ones really mean something to you and your family.

Neither Oregon Pacific Financial Advisors, Inc. nor its financial professionals render legal or tax advice. Please consult your tax and legal professionals regarding your specific situation.