Five for Friday – August 8, 2025

Earnings, Concentration, Cash, New Business, Invention

1. Profit

We’re more than three-fourths of the way through the second quarter earnings season (when public companies deliver financial updates), and we can safely say this: The Companies Are Alright. The expected year-over-year growth rate now stands at +10.2% (vs. the 4.9% forecast on June 30), over 80% of companies have surpassed analyst expectations, and earnings data has surprised to the upside by a substantial amount. Finally, a smaller-than-usual number of firms are issuing negative outlooks for the quarter to come. Why have stocks been so resilient of late? Given that a share of stock is nothing more than a unit of ownership in a company (and its earnings), perhaps Occam’s Razor can be of some use: profits are up, and so are the stocks of the companies earning them.

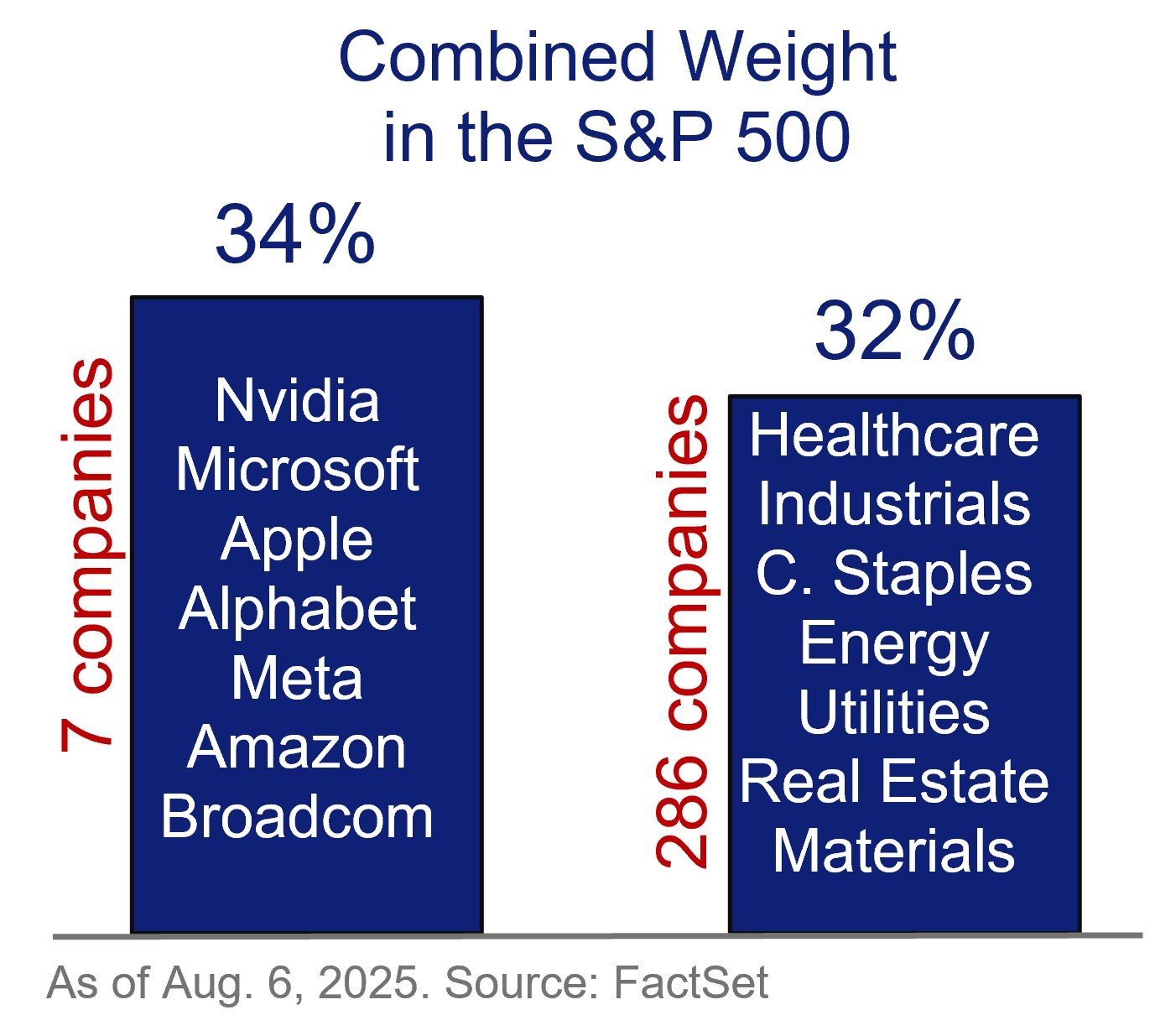

2. Big

The 10 biggest companies now account for ~40% of the S&P 500, marking a new 45-year high (at least), per our partners at Strategas. In fact, the 7 biggest stocks in the index—all AI-adjacent tech / consumer tech firms—now have a larger market cap than the 7 smallest sectors in their entirety. Nvidia alone is larger than all companies in the Energy, Utilities, and Real Estate sectors combined. Now, concentration is not in and of itself very predictive of forward returns, but it does raise the question of whether indexes that purport to be diversified actually are. Of course, when the area of concentration is outperforming, no one complains—and if the 1990s are an apt comparison, this AI-driven boom could have room to run. But nothing outperforms in perpetuity. At a minimum, today’s concentration is an opportunity to consider whether your portfolio is really as diversified you want (or need) it to be.

3. Cash

U.S. stocks are within a hair of all-time highs, but so are assets in money market funds—nearly $8 trillion and counting. Money market funds function similarly to cash since they can be used for short-term liquidity needs. However, storing large sums in money market funds for long periods of time has an opportunity cost. Over the last 90 years, U.S. large-cap stocks returned 7.3% annually, roughly +56,000% in total, after reducing for inflation. Over that same 90 years, ultra-short-term Treasury bills (a common money-market holding) had a real return of -14%. In total. Things are uncertain today, but the relative comfort of a cash-like instrument introduces the risk that the creep of inflation will quietly erode your wealth over time.

4. Entrepreneurialsim

Despite the many bandied-about macro-economic headwinds of 2025—from tariff policy to geopolitical conflicts and everything in between—Americans are forming new businesses at the fastest rate in at least 20 years. With job growth stalling, this surge in entrepreneurialism is a ray of hope given that a majority of net job creation in recent years has come from small business.

5. On this day

in 1911, the U.S. granted its one millionth patent. It would take 80 more years to get to patent number 5 million, but by then the pace of innovation and entrepreneurialism was picking up. Patent 10 million was issued in 2018 and number 12 million in 2024. Innovation—and the public sharing of inventions made possible via the patent system—is critical in fostering economic growth and advancing humankind. I’d expect the next 10 million to come much quicker.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.