Five for Friday - May 2, 2025

GDP, Rallying, Rate Cuts, Consumer Confidence, and GPS

1. Economy

A few thoughts on the first negative GDP quarter since 2022. Let’s start with why it was negative. Imports are subtracted from GDP because GDP measures domestic production, and Q1 saw a massive increase in imports as companies stocked up ahead of tariff implementation. In fact, as measured by its contribution to percentage change in GDP, net exports (i.e., exports minus imports) was the biggest weight on GDP growth since 1947. On the other hand, consumer spending and private fixed investment actually rose by 3.0% in Q1, which was better than Q4 2024. Consumer spending on services was solidly positive, and business investment – particularly in the Tech sector – was a huge positive. This data is full of distortions (tariffs, weather, strikes, etc.) and will almost certainly be revised later (as nearly all economic data is), but it basically describes an economy that is healthy enough today and is also battening down the hatches for a tariff shock. We’ll see. The other thing worth noting is that the NBER defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months,” and NOT as “back-to-back quarters of negative GDP,” as is often heard repeated by the media. None of these explanations changes how the economy is actually doing, but it is useful context when thinking about investing and when consuming news and commentary.

2. Rally

Last week, the S&P 500 gained 1.5% or greater for each session of a 3-day stretch. This is a rare occruence and has, historically, tended to precede good performance from stocks. In fact, the median 1-year forward return from these events over the last 75 years is +24%, with these clusters of big up-days typically clustering around big market lows (May 1970, Oct. 1982, Aug. 2002, Oct. 2011, etc.). This type of action – stringing together multiple strong days in a row – runs counter to the up-and-down volatility we’ve seen in recent weeks, and is at least one sign that investors are growing more comfortable with the playing field (despite the obvious risks of a trade war). The economic outlook remains cloudy at best, and a potential ride to a strong 1-year return can still be turbulent, but the recent action is a positive signpost nonetheless.

3. Cuts

One potential tailwind for the stock market in the second half of 2025 would be further interest rate cuts. Right now, the Federal Reserve is on a firm “pause” due to tariff uncertainty. Setting that aside, the inflation picture looks pretty solid. Gasoline prices are down, and shelter inflation – the biggest component of CPI – is at its lowest year-over-year growth rate since November 2021. Via Redfin, in March U.S. home prices rose at their slowest pace since 2022, (and fell from the previous month in 20 of the 50 most populous U.S. metros) and CPI ex-shelter sits at just 1.5%. If the Fed gets the news it wants on the trade front (i.e., lowered tariffs), the inflation backdrop could be cut-friendly sooner rather than later.

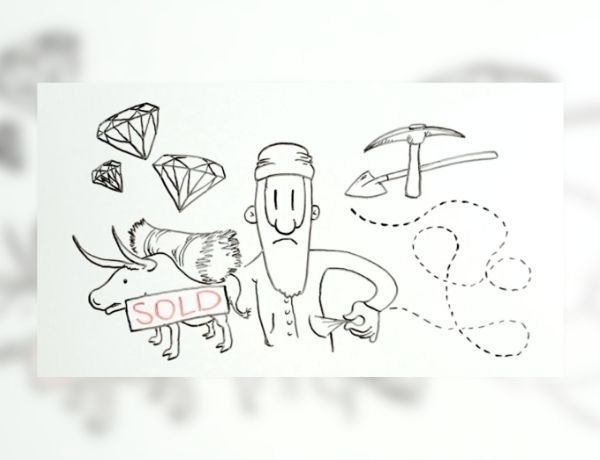

4. Consumer

A lot is being made of the downturn in consumer confidence. While the consumer’s perception of the labor market shouldn’t be ignored, the chart to the right shows how little it matters when it comes to predicting market returns.

5. On this day

in 2000, President Bill Clinton’s decree that accurate GPS would no longer be restricted to just the U.S. military went into effect, opening the door for widespread commercial and civilian applications. A recent study estimated that GPS between 1984 and 2019, created roughly $1.4 trillion in economic benefits, with most of the benefit accruing decades after the mid-century innovations that sowed the seeds for its proliferation. As the proverb says, “A society grows great when old men plant trees whose shade they know they’ll never sit in."

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.