Five for Friday - July 11, 2025

Tariffs, All-Time Highs, Job Growth, Market Speed, and Highways

1. Tariffs

With the ink still wet on President Trump’s milestone tax bill, focus abruptly shifted back to a flurry of tariff pronouncements. Time is a flat circle. My take: it’s ok to put the tariff stuff into the “too tough” basket. Trying to keep track of the various rate proposals, shifting deadlines, and non-tariff barriers has become a full-time job. The use of executive authority to levy the tariffs (which is being challenged in court) means reversals and/or ramp-ups can occur at any moment. It seems fair to conclude that tariff rates, wherever they settle, will be higher than they’ve been in decades, both because President Trump likes using tariffs to pursue domestic policy goals (e.g., reshore manufacturing) and because the revenue will be important to manage the budget deficit under the new tax law. And while tariff uncertainty could hinder business investment, some of that will be offset by the pro-growth incentives included in the OBBBA. But ultimately, as we saw in April, selling stocks or getting too defensive could put you on the wrong side of a no-looking-back, mega-rally. Headline volatility is here to stay but that doesn’t preclude further market gains.

2. Highs

Although it feels like we’ve had a decade’s worth of news since January, the S&P 500 ended June at a fresh record high. Perhaps counterintuitively, this is a bullish indicator: forward returns from all-time highs have been better than average over the last half century. While it’s inevitable that some new highs will be near-term market peaks, it’s far more common that they signal better things to come. All-time highs rarely occur in isolation; momentum begets momentum in markets, and all-time highs typically beget more new highs before the party ends. Though the market is higher today than ever before, taking money off the table now could be betting against the weight of history.

3. Jobs

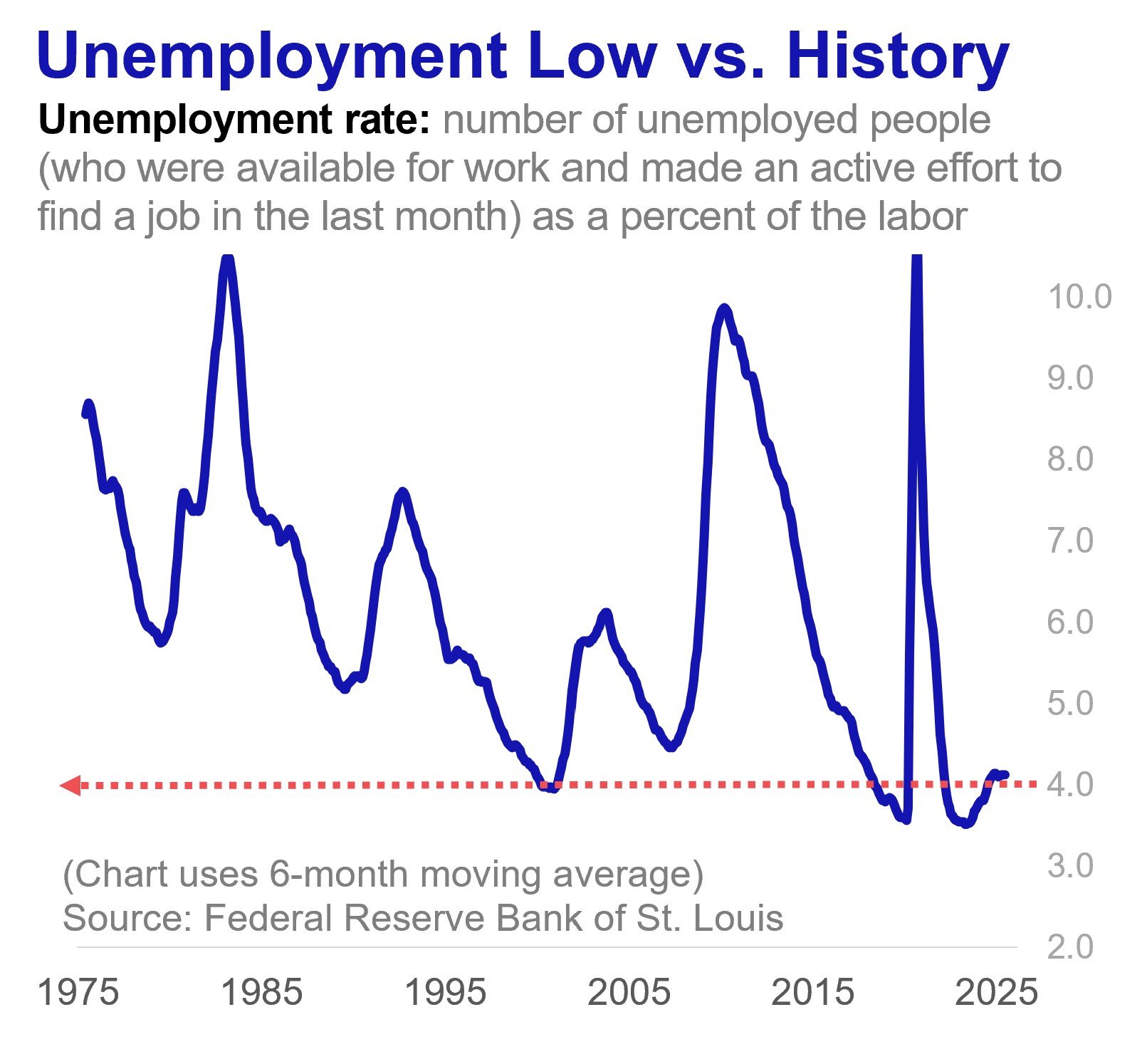

The U.S. added 147,000 jobs in June, bringing average payroll growth to 130,000 per month in 2025. Is that good or bad? On one hand, we’ve added jobs for 54 months in a row. On the other hand, 130,000 per month would be the lowest annual (non-Covid) rate since 2010. So how can we evaluate? One way is to use “breakeven growth,” which asks, “how many jobs do we need to add to keep up with the growth in the labor force?” The idea is straightforward: Each month, the number of people available to join the labor force changes (due to factors like immigration and aging) and to keep the unemployment rate from rising, job growth must match labor force growth. Enter this handy dandy calculator from the Atlanta Fed, which shows that if we hold population growth and labor force participation steady at recent levels, we only need to add 113,500 jobs per month to break even (fewer if we presume that population growth will slow amid tighter immigration policies). For those who watch that monthly jobs number, this is a great way to think about success vs. failure.

4. Rallies

The recent roller coaster from market peak (Feb. 19) to selloff low (Apr. 8) to new high (Jun. 27) was the fastest roundtrip for a selloff of 15% or greater in at least 75 years. But while the speed of this rebound was uncommon, the trend towards faster-moving markets is not. Since 1940, there have been 22 separate selloffs of 15% or greater in the S&P 500. For the first 11 (1940 – 1982), the median roundtrip time from peak to new high was 705 days. For the most recent 11 (1982 – 2025), the median time for the same trip was just 215 days. As information processing and transmission get faster, so does the market’s reaction, making volatility feel even more intense and attempts to time the market even more fraught.

5. On this day

in 1916, The Federal Aid Road Act ‒ the U.S.’s first federal highway funding legislation ‒ was enacted. Though largely unsuccessful due to World War I strains, it paved (wink, wink) the way for more impactful legislation down the line, with the Interstate Highway System ultimately contributing hundreds of billions (at a minimum) to U.S. economic growth.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.