Five for Friday – August 22, 2025

International, Tariffs, Housing, Investor Performance, and Panics

1. Highs

Last week, the MSCI All Country World (excl. US) index made a new all-time high. Over a dozen individual country constituents also hit new all-time highs (Japan, France, Peru, Australia, Hungary, Canada, etc.), with many more breaking out to new multi-year highs (Poland, South Africa, etc.). Importantly, most of these countries’ stock markets are not filled with Big Tech behemoths and A.I. “winners” (Japan’s biggest sector is Industrials, Poland’s is Financials, Peru’s is Materials). Bull markets are more robust when they are broader in nature – both in terms of country and sector participation – and today’s rally fits the bill almost any way you slice it. And while I wouldn’t argue for underweighting U.S. stocks or Big Tech, I do believe that strength from international stocks (particularly amid sustained U.S. dollar weakness) argues for revisiting global diversification.

2. Trade

For those doing their best to keep up with all of the trade and tariff headlines (no small task), our partners at Strategas produced a quick update this week. They get into where the effective tariff rate might actually shake out (hint: lower than is being reported) and what might happen if the bulk of Trump’s tariffs are deemed illegal.

3. Housing

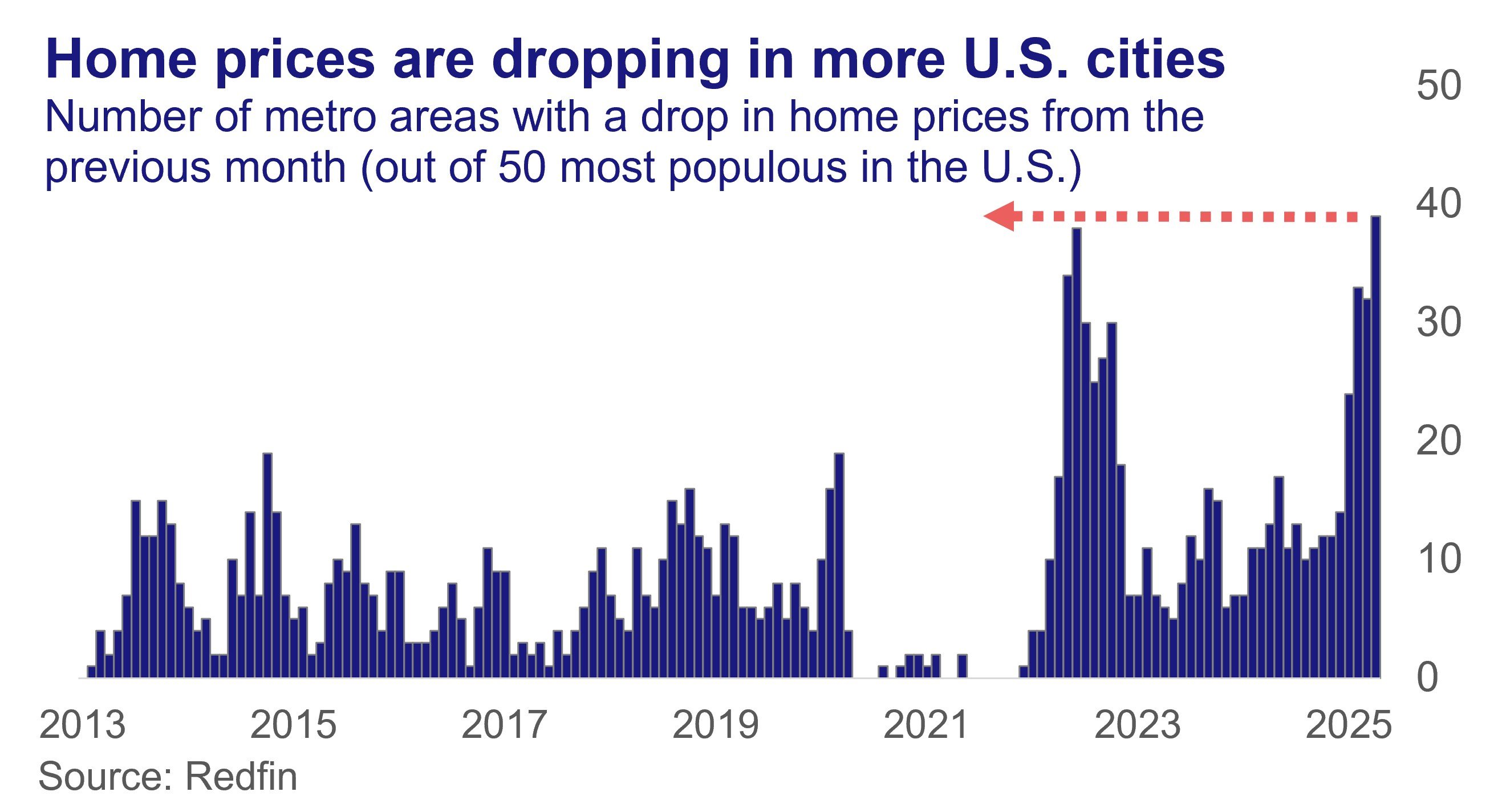

For all intents and purposes, the housing market is frozen. Home-builder sentiment is in the tank, housing starts are down, and buying/selling is stagnant. One benefit of this sluggishness is that prices have cooled – Redfin just saw its third straight month-over-month decline in home prices, with 39 of the top 50 U.S. metros seeing drops. This will help with inflation where, despite all the tariff talk, shelter is the primary driver (inflation ex-shelter has averaged just 1.9% over the last 30 months). Tariffs may yet spark an uptick in goods prices, but the cooling of shelter costs gives the Fed room to cut rates next month, as expected.

4. Gap

Morningstar’s “Mind the Gap” study, which tracks the difference between funds’ reported performance and the return investors actually see, again showed that people tend to underperform the investments they own. Morningstar estimates that the average dollar invested in U.S. funds earned 7.0% per year over the decade ended Dec. 31, 2024, versus the funds’ aggregate return of 8.2%. This “gap” of 1.2% a year amounted to investors underperforming their funds by ~15% over 10 years. Interestingly, Morningstar found that the gap was larger for funds with more-volatile cash flows; said another way, more investor activity actually led to lower returns, likely both due to poor market timing and the costs of overtrading. To quote economist Eugene Fama, “Your money is like a bar of soap – the more you handle it, the less you’ll have.”

5. This weekend

168 years ago, the Panic of 1857 began with the failure of the Ohio Life Insurance and Trust Company’s New York branch. The boom and bust nature of the U.S. economy in the 1800s fueled many such panics, though this episode was heightened by the speed that word traveled due to the rise of the telegraph (SVB precursor?). In 1858, a post-mortem report included language that rings as true today as ever about the nature of financial panics: “it struck on the public mind like a cannon shot…flying rumors were exaggerated at every corner…every individual misfortune was announced on the news bulletins in large letters, and attracted a curious crowd, which was constantly fed from the passing throng. A financial panic has been likened to a malignant epidemic which kills more by terror than by real disease.”

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy. Market and economic statistics, unless otherwise cited, are from data provider FactSet.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation, or need of any particular client and may not be suitable for all types of investors. Recipients should not consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

For investment advice specific to your situation, or for additional information, please contact your Baird Financial Advisor and/or your tax or legal advisor.

Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Copyright 2025 Robert W. Baird & Co. Incorporated.

Other Disclosures

UK disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds an ISD passport.

This report is for distribution into the United Kingdom only to persons who fall within Article 19 or Article 49(2) of the Financial Services and Markets Act 2000 (financial promotion) order 2001 being persons who are investment professionals and may not be distributed to private clients. Issued in the United Kingdom by Robert W. Baird Limited, which has an office at Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB, and is a company authorized and regulated by the Financial Conduct Authority. For the purposes of the Financial Conduct Authority requirements, this investment research report is classified as objective.

Robert W. Baird Limited ("RWBL") is exempt from the requirement to hold an Australian financial services license. RWBL is regulated by the Financial Conduct Authority ("FCA") under UK laws and those laws may differ from Australian laws. This document has been prepared in accordance with FCA requirements and not Australian laws.