All That Matters: All-Time Highs, All-Time Worries

8/5/2025

It’s the heart of summer 2025, and the stock market has been on a remarkable run – rebounding from April’s stormy selloff, climbing despite persistent uncertainty around a sweeping tax bill, and closing at multiple new all-time highs throughout July. In this episode, Mike and Ross address three big worries that may feel new, but have faced investors many times before.

Investing at the Peak

Mike: As the market reaches new all-time highs, a familiar myth tends to resurface – the idea that you should sell when the market hits a peak. We addressed this myth in our mythbusting episode, but it’s worth repeating: the market reaching an all-time high is not a reason to sell. I’d put it this way – you can’t let anxiety take over when the market is going down or when it’s going up. It’s important to stay grounded and avoid letting emotions drive your investment decisions, regardless of the direction of the market.

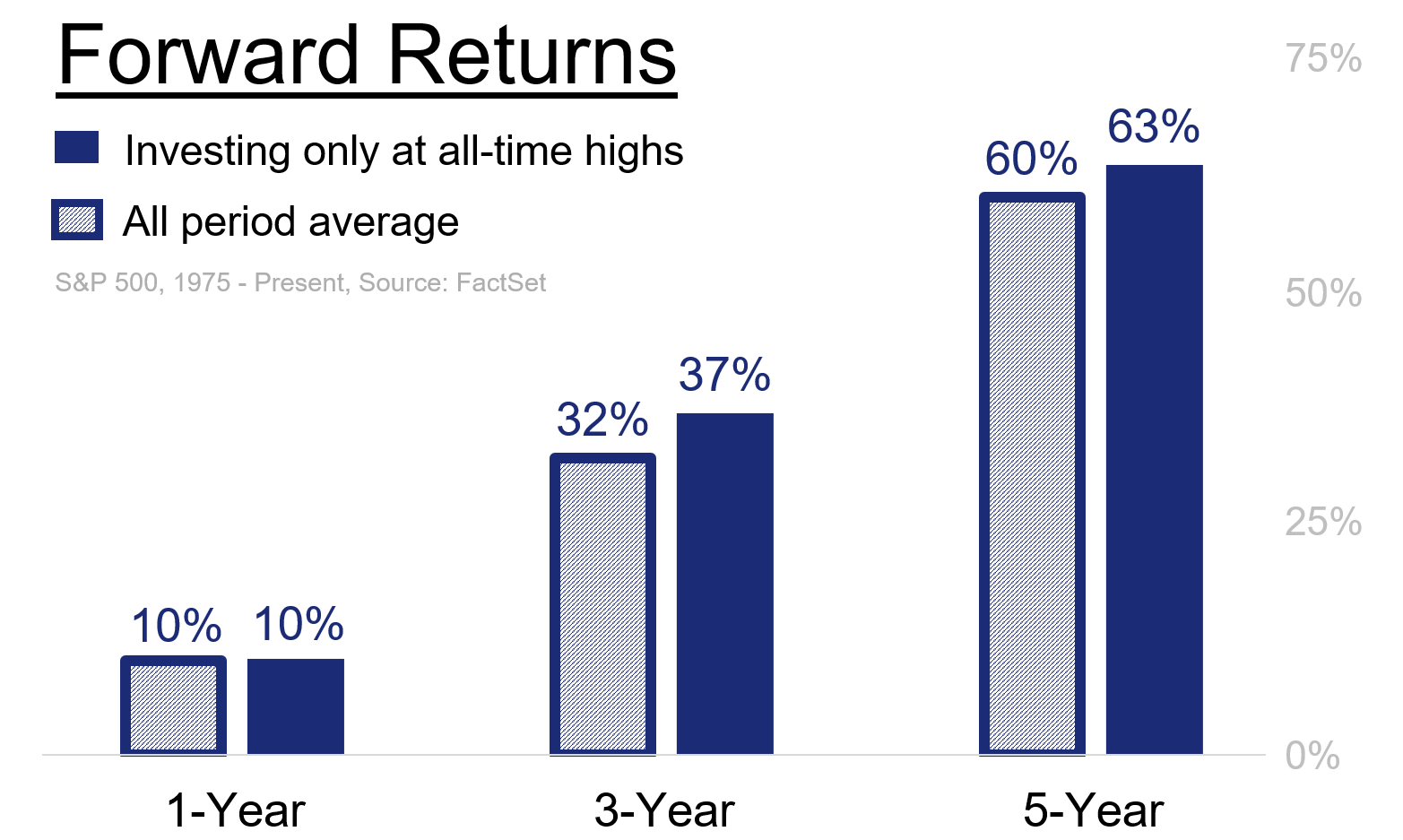

Ross: There are plenty of reasons to feel optimistic about investing at all-time highs. Historically, forward returns are actually stronger when you stay invested through them. We hit all-time highs a lot; it’s not like standing at the edge of a cliff but instead like reaching a base camp on a long climb. Since the 2009 bear market ended, we’ve seen over 400 all-time highs. The only calendar year since 2013 without one was 2023. So, if you had jumped out at the new all-time highs in 2014, you would have missed out on one of the greatest bull markets of all time. The same goes for 2018 and 2020. All-time highs don’t happen during recessions or bear markets – they’re a sign that things are working.

Mike: When the market peaks, it usually means that key indicators like company earnings and consumer spending are on the rise. While the market can shift quickly and rarely moves in a straight line, staying invested is essential for you to benefit from its ongoing growth and innovation.

The information offered is provided to you for informational purposes only. Robert W. Baird & Co. Incorporated is not a legal or tax services provider and you are strongly encouraged to seek the advice of the appropriate professional advisors before taking any action. The information reflected on this page are Baird expert opinions today and are subject to change. The information provided here has not taken into consideration the investment goals or needs of any specific investor and investors should not make any investment decisions based solely on this information. Past performance is not a guarantee of future results. All investments have some level of risk, and investors have different time horizons, goals and risk tolerances, so speak to your Baird Financial Advisor before taking action.